Industries with High Relevance of Free Cash Flow Yield

Industries with High Relevance of Free Cash Flow Yield

Free cash flow yield proves to be a particularly insightful metric for investment analysts across a range of industries, each with its own specific nuances and applications.

🏦 Mature and Stable Industries

In mature and stable industries such as utilities and consumer staples, companies often exhibit higher and more predictable free cash flow yields. This is typically due to their established business models, which generate consistent revenue streams, and their relatively lower capital expenditure requirements for growth compared to more dynamic sectors.

Utility companies generally have steady, regulated cash-generating operations, often leading to attractive free cash flow yields. Telecom companies like Verizon (VZ), which generates $18.3B in annual FCF, also exhibit these characteristics. Similarly, consumer staples companies, which provide essential goods with consistent demand, can also demonstrate appealing yields.

For investment analysts examining these sectors, free cash flow yield is exceptionally useful (see the advantages of using FCF Yield) for evaluating the sustainability and potential growth of dividends. Companies in mature industries often distribute a significant portion of their free cash flow to shareholders in the form of dividends, making the yield a critical metric for income-focused investors.

⚙️ Capital-Intensive Industries

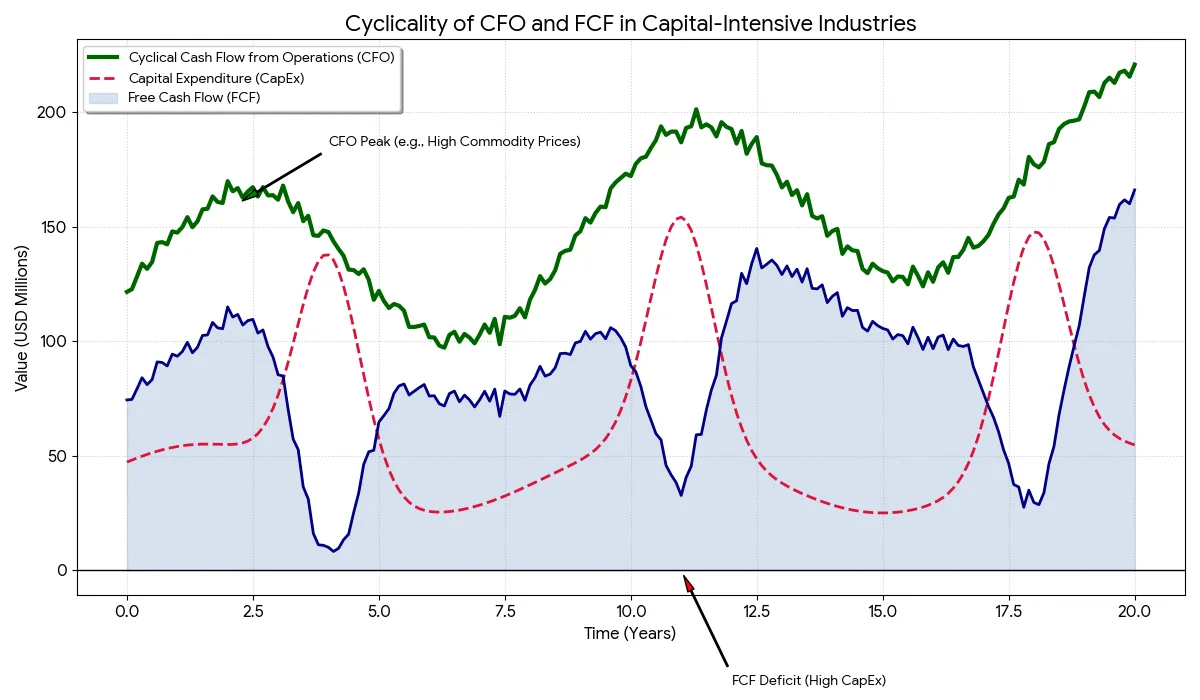

Capital-intensive industries, such as energy and basic materials, require substantial ongoing investments in property, plant, and equipment. In these sectors, free cash flow yield is crucial for evaluating how efficiently companies are managing these significant capital allocations and their ability to generate returns despite the high expenditure.

These industries are also often characterized by cyclicality, with cash flows that can fluctuate significantly based on commodity prices. Free cash flow yield provides a valuable real-time snapshot of a company's current cash generation relative to its valuation, which can assist analysts in assessing its resilience during economic downturns or periods of commodity price volatility.

Industry Examples

- BP - High trailing free cash flow yield

- Shell - Prioritizing free cash flow generation

- Rio Tinto - Attractive yield despite cyclical industry

- Teekay Corp (TK) - Shipping company with 92% FCF conversion rate

📈 Industries with Strong Growth Potential

In industries with strong growth potential, such as technology and certain segments of the industrials sector, free cash flow yields might be comparatively lower. This is often because these companies are reinvesting a significant portion of their earnings back into research and development and expansion initiatives.

A healthy free cash flow yield in growth-oriented companies can also serve to validate the quality of their reported earnings, ensuring that the profits are indeed backed by tangible cash generation. Analysts need to interpret the free cash flow yield in these industries while considering the company's reinvestment strategy.

Case Study: Google

Google saw a decrease in free cash flow due to significant capital expenditures in servers for its AI initiatives, illustrating this trade-off between current cash flow and future growth potential.

🏢 Real Estate

In the real estate sector, free cash flow yield is a relevant metric for evaluating the cash-generating ability of Real Estate Investment Trusts (REITs) and other real estate companies. This is typically based on the rental income generated from their properties after accounting for operating expenses and any capital expenditures.

Key Factors Affecting REIT FCF Yield

- Occupancy rates

- Rental growth

- Operating expense management

- Property maintenance costs

Analysts can use this metric to assess the attractiveness of REITs by comparing the cash generated from rents relative to the market value of the REIT. A higher free cash flow yield can suggest a more profitable and potentially undervalued REIT, particularly when compared to its peers within the same property type and geographic location.

📋 Key Takeaways

- Mature industries typically show higher, more stable free cash flow yields

- Capital-intensive sectors require careful analysis of FCF yield to assess capital efficiency

- Growth industries may have lower yields due to reinvestment, but should show positive trends

- Real estate investments benefit from FCF yield analysis to evaluate property performance