The Advantages of Free Cash Flow Yield in Investment Analysis

The Advantages of Embracing Free Cash Flow Yield in Investment Analysis

Free Cash Flow Yield (FCFY) has become an increasingly important metric for investors seeking to evaluate companies beyond traditional accounting measures. This article explores the key advantages of incorporating FCFY into your investment analysis framework.

📊 Enhanced Reliability Compared to Earnings-Based Metrics

One of the primary advantages of using free cash flow yield as an investment parameter is its enhanced reliability compared to metrics based on accounting earnings, such as the price-to-earnings (P/E) ratio. Free cash flow is a measure of the actual cash a company generates, making it less susceptible to accounting manipulations and non-cash items that can distort reported earnings.

The cash flow statement, from which free cash flow is derived, is generally considered a more reliable representation of a company's financial performance than the income statement. This is because it is more difficult to conceal financial misdeeds or make aggressive accounting adjustments in the cash flow statement.

FCFY focuses on actual cash generation rather than accounting profits, providing a clearer picture of a company's financial health.

💡 Enhanced Flexibility and Assessment of Growth Potential

Companies that generate strong free cash flow, reflected in a healthy FCFY, possess greater financial flexibility. This flexibility allows them to manage their debt more effectively, invest in growth opportunities such as research and development or acquisitions, and return capital to shareholders through dividends and share buybacks.

Benefits of Strong Free Cash Flow

- Better debt management

- Increased R&D investment capability

- Strategic acquisition opportunities

- Enhanced shareholder returns

This ability to strategically allocate capital can lead to sustainable long-term growth and ultimately enhance shareholder value. A robust FCFY not only indicates current financial strength but also suggests the potential for future value creation through prudent capital deployment.

🔄 Facilitating Meaningful Cross-Industry Comparisons

Free cash flow yield can be a valuable tool for comparing the cash-generating efficiency of companies within the same industry. By comparing the FCFY of companies operating in similar sectors, investors can identify those that are generating more cash relative to their market capitalization, potentially indicating superior operational efficiency or an undervalued stock price.

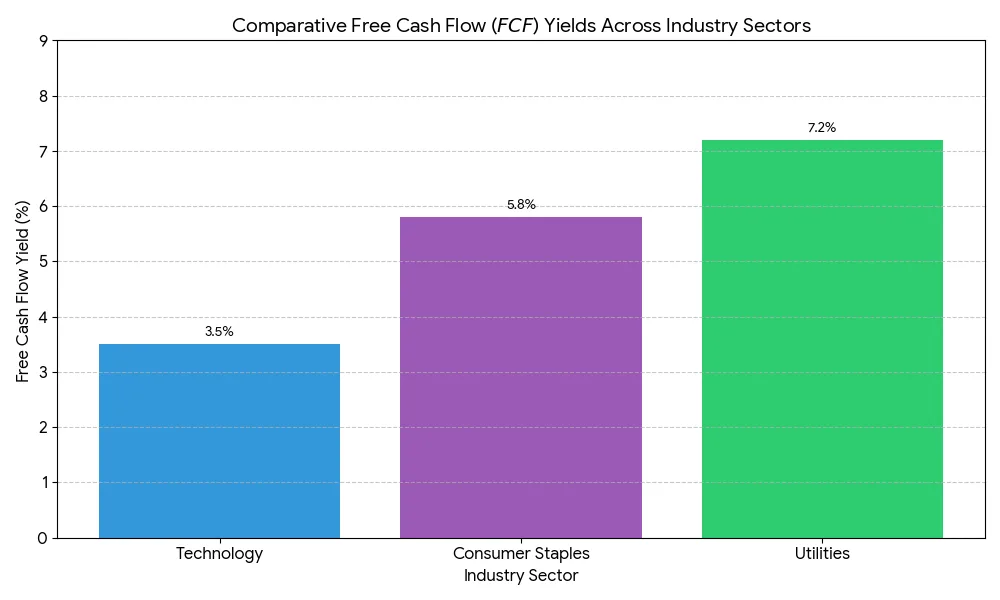

However, it is crucial to recognize that FCFY can vary significantly across different industries due to variations in capital expenditure requirements and business models. For example, technology companies that reinvest heavily in growth might have lower FCFY compared to mature utility companies with steady cash flows.

Industry Comparison Examples

- Technology - Often lower FCFY due to high R&D investment

- Utilities - Typically higher FCFY with stable cash flows

- Consumer Staples - Moderate to high FCFY with consistent demand

Practical Application

When comparing two retail companies, Company A with a FCFY of 8% versus Company B with 5%, an investor might conclude that Company A is generating more cash relative to its market value, potentially making it a more attractive investment if all other factors are equal.

📋 Key Takeaways

- Free cash flow yield provides more reliable insights than earnings-based metrics

- Companies with strong FCFY have greater financial flexibility for growth and shareholder returns

- FCFY enables meaningful comparisons within the same industry

- Consider industry context when evaluating FCFY across different sectors

Incorporating free cash flow yield into investment analysis provides a more comprehensive and reliable framework for evaluating companies. By focusing on actual cash generation (and assessing the quality of that cash flow) rather than accounting metrics, investors can better assess a company's financial health, growth potential, and relative value compared to industry peers. While FCFY should not be used in isolation (investors should also watch for important red flags), it represents a powerful addition to any investor's analytical toolkit.